Michael B. Wright

SENIOR MORTGAGE BANKER

Wright Home Loans NMLS 219994

C: 360.719.8750

michaelw@go-summit.com

Summit Mortgage Corporation | NMLS 3236

Licensed to originate loans in OR/WA

Meet Michael B. Wright

As an experienced industry professional, Michael B. Wright is able to offer his clients a wide variety of loan products that will help secure affordable financing on three levels: purchases, refinances, and renovations.

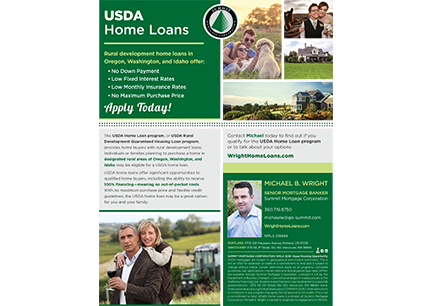

Summit Mortgage Corporation is a direct lender, which means they have the unique ability to underwrite and approve loans in-house. Additionally, Michael and the Summit Mortgage Corporation team specialize in programs for first-time home buyers, as well as FHA, VA, and USDA home loans.

With the real estate and financial markets seemingly changing on a weekly basis, it is important that your mortgage banker understands your desires, as well as short- and long-term goals. Michael takes it upon himself to ensure competitive financing is secured for all of his clients. He personally price shops competition and is confident that Summit Mortgage Corporation’s fee structure and rates are more than competitive.

A native of the Pacific Northwest, Michael attended Jesuit High School, followed by Washington State University, where he obtained a Bachelor of Science from the School of Architecture and Engineering. He also received a minor in Real Estate and Business. In his free time, Michael enjoys fitness and anything sports related with his lovely wife and two children. Michael was honored with the Top 1% of Originators in America Award in 2016 by Mortgage Executive Magazine.

Industry Accomplishments:

- Top 1% of Originators in America Award | Mortgage Executive Magazine ~ 2016, 2017

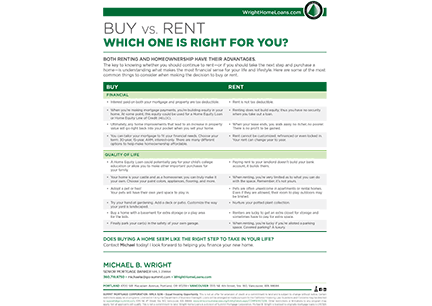

Purchasing A Home

Your dream home is at your fingertips. Whether you’re buying a home for the first time or looking for the perfect vacation home, we’ll help find the financing option that’s right for you.

Need To Refinance?

Saving money is good. Refinancing can help you obtain a lower interest rate, leverage your home’s equity, or simply lower your monthly payments. Let’s find a refinance solution and make it happen! Capitalize on these low rates.

Niche Products

We offer a wide array of niche products, as well as mortgage loans for manufactured and modular homes, properties with large acreage, Washington State bond programs, low-interest second mortgages, future income programs, extended lock options, and more.

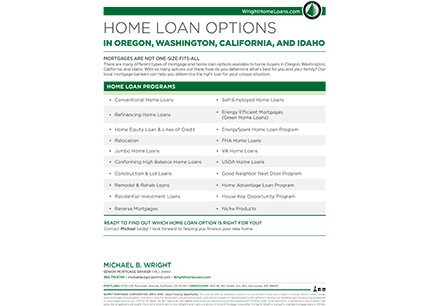

Loan Options

Purchasing or Refinancing in Oregon or Washington?

Look no further. We have a wealth of knowledge on a wide range of financing options. Here are just some of the home loan programs we specialize in:

- Conventional Home Loans

- Fixed & Adjustable Rate Mortgages

- Refinancing Home Loans

- Relocation

- Jumbo Home Loans

- Conforming High Balance Home Loans

- Construction & Lot Loans

- Remodel & Rehab Loans

- Residential Investment Loans

- Reverse Mortgages

- Self-Employed Home Loans

- Energy Efficient Mortgages (Green Home Loans)

- EnergySpark Home Loan Program

- FHA Home Loans

- VA Home Loans

- USDA Home Loans

- Good Neighbor Next Door Program

- Home Advantage Loan Program

- House Key Opportunity Loan Program

- Niche Products

Learn more about available loan options and apply today with Michael.

Team

Pam Slasor

Senior Loan Processor

O: 360.433.0299

pams@go-summit.com

Angie Dannenmann

Production Coordinator

O: 360.567.2320

angied@go-summit.com

Jill Martini

Processing Manager

O: 503.416.5161 | F: 503.336.1002

jillm@go-summit.com

NMLS 1119107

Jennifer Journet

Licensed Transaction Coordinator

O: 360.433.0189 | F: 360.334.9550

jenniferj@go-summit.com

NMLS 880572

Testimonials

Michael & Jennifer went above and beyond for us and our home purchase! Thank you!!

We love Michael and his team! I feel free to ask questions at any time and he is always prompt on answering even when he is on vacation.

Thank you Michael and team, you are an amazing group that make this complicated process seem very easy!